Wealth & Legacy: Estate Planning and Asset Preservation

Essential Steps to Protect What Matters Most

Prepare for the future with confidence by mastering the essentials of estate and asset preservation. This focused seminar explores the key strategies to protect your legacy, minimize taxes, and ensure your wishes are carried out. Gain expert insights on estate planning tools and tax-efficient solutions to preserve wealth and provide peace of mind for you and your loved ones.

What can you expect to learn from this class?

Gain clarity on how wills and various types of trusts (such as revocable and irrevocable) work, and identify the options that best meet your tax-efficient estate planning goals.

Learn strategies to bypass the probate process, saving time and reducing expenses for your heirs.

Understand how to keep your estate matters private and ensure your wishes are carried out without court intervention.

Explore tax-efficient strategies to reduce the burden of estate and inheritance taxes on your beneficiaries.

Regularly reviewing and updating your estate plan is essential to account for life changes, maximize tax efficiency, and stay aligned with new laws.

Discover methods to safeguard your assets against the high costs of nursing home care and other long-term care expenses.

Confidently Navigate The Complexities Of Estate Planning, Taxes, And Wealth Preservation

This informative seminar is designed to equip you with the knowledge and strategies necessary for effective estate planning and long-term wealth preservation. You'll explore the differences between wills and trusts, along with tax-efficient strategies that may help minimize liabilities and maximize what you pass on to your loved ones.

Estate planning isn’t just for the wealthy—it’s essential for anyone who wants to ensure their wishes are honored and their loved ones protected. A will provides clear instructions for asset distribution, while a trust can help you avoid probate, maintain privacy, and exercise greater control over how and when assets are transferred. Together with smart tax planning, these tools may reduce family conflict, lower the burden of estate taxes, and protect your legacy for generations.

By taking the time to understand your options now, you'll gain the confidence to create a clear, customized plan that reflects your priorities. Whether you’re starting fresh or updating an existing plan, this seminar will empower you to take meaningful steps toward protecting what matters most.

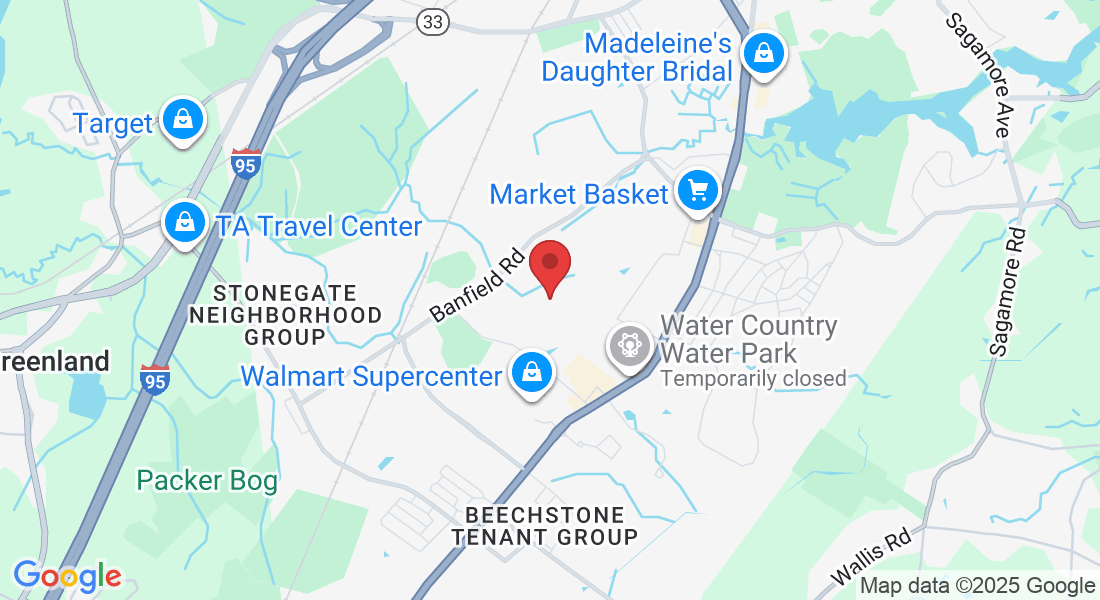

Register to join us at Portsmouth Community Campus for this informative class focused on estate planning and tax strategies on Tuesday, December 9th at 6:00 PM ET.

This session delivers up-to-date guidance on the key obstacles in estate planning and tax-efficient wealth preservation and how to overcome them. Learn how to structure your estate to avoid unnecessary taxes, protect your beneficiaries, and maintain control over how your assets are managed and distributed. By the end of the class, you'll be equipped to build a solid estate plan that reduces financial and emotional burdens on your loved ones—and helps you leave the legacy you intend.

Join us on 12/9/25 at 6:00 PM ET for this specialized, no-obligation class.

Space is limited. Sign up today!

TUESDAY

December

9

6:00 PM

Frequently Asked Questions

Who is this seminar for?

The insights provided in our estate planning and tax strategies seminar are valuable for anyone seeking to protect their assets, provide for loved ones, and ensure their wishes are honored.

What's the purpose of this class?

This class is designed to be entirely educational, providing attendees with valuable insights into key aspects of estate planning.

Topics covered include:

• The pros and cons of beneficiary designations

• The pros and cons of Trusts

• The costly mistakes people make when trying to avoid probate

• Common planning mistakes that cause unnecessary taxes for you and your heirs

• Tax-efficient wealth preservation strategies

• The essential legal documents everyone should have and why

• And much more...

While presenters may offer business cards or brochures for informational purposes, there is no obligation to interact with them during or after the class.

Who is the speaker/presenter?

Mark Patterson is an Independent Registered Investment Advisor (RIA) with more than 27 years of experience in the financial services industry. He serves clients throughout Maine, New Hampshire, Rhode Island and Massachusetts.

Mark received his Master of Business Administration in Finance from Anna Maria College and his Bachelor of Science in Economics and Marketing from Roger Williams University. He first started in the industry as a broker, building portfolios with individual stocks. In realizing his passion for working closely with clients, he transitioned into asset management and became an independent advisor. Today, he runs his own practice, providing fee based comprehensive financial planning services and products.

Passionate about education, Mark previously taught finance and business at several colleges and universities in New Hampshire and Rhode Island, including Roger Williams University and Granite State College. He enjoys public speaking and frequently offers seminars and presentations for the public, as well as private organizations.

Through years of hands-on experience, he's developed practical, personalized solutions that tackle the most common trust and estate planning concerns. He empowers families to build meaningful, effective plans – never generic ones. He's guiding purpose is simple yet powerful: to make estate planning a process that everyone can understand, trust, and take action on.